By Jimmy O’Donnell and Kenan Fikri

Too few Americans benefit sufficiently from the immense wealth creation power of the U.S economy. To address that challenge, conservative economist Kevin Hassett partnered with progressive economist Teresa Ghilarducci to co-author a white paper for EIG where they called for a new retirement savings program modeled after the federal Thrift Savings Plan as an economically effective way to boost the overall wealth of millions of Americans, especially those in the bottom half of the income distribution.

This data snapshot will explore the geographic variation in access to, and participation in, employer-provided retirement plans. It relies on the best-available state-level data from the government’s Current Population Survey (CPS) to do so.

First, a note on sources and methods. All data and information that is publicly available on retirement plan access and participation in the United States is derived from surveys such as the Federal Reserve’s Survey of Consumer Finances, the Census Bureau’s Survey of Income and Program Participation, or the Bureau of Labor Statistics’ National Compensation Survey. The only source to provide sub-national detail is the Census Bureau’s CPS. While researchers have found some biases in CPS’ retirement-related estimates relative to other sources at the national scale, the dataset still provides the only reliable state-level information on this critical element of Americans’ lifetime financial security.

Retirement plan coverage runs lowest in the Sun Belt and urban Northeast

Figure 1 shows clear variation in retirement plan access by state. For example, Minnesota leads the nation with 59 percent of its workers having access to an employer-provided retirement plan, whereas Florida comes in last with only 36 percent of its workers having access to such a plan. Nationwide, 46 percent of workers have access to an employer-provided retirement plan, and 15 states (primarily those located in the Southeast and Southwest, but also California and New York) are below that national average. As the next section will show, these figures mask significant inequalities in plan access and participation by income.

Figure 1.

Even when plans may be offered by employers, many workers do not take advantage of them. Across every state, actual participation in offered plans runs far below access to them (the tooltip on the interactive map also reports participation rates). For example, in Florida and Texas only 29 percent of respondents report participating in a plan, the lowest rates nationally. By comparison, nationwide 38 percent of respondents say they are included in an employer plan, a figure that rises to roughly half of all workers in Hawaii, Iowa, and Minnesota—the leaders.

Lower wage workers report significantly lower rates of retirement plan participation in every state

Looking only at workers in the bottom portion of the earnings distribution (here, earning less than $50,000 per year, a cut that includes many part-time and temporary workers), we see that rates of retirement plan access and participation are much lower for workers with lower incomes. In every single state, access to a retirement plan was at least 3.5 percentage points lower and participation in a retirement plan was at least 6 percentage points lower for the low-wage workforce than it was for the overall workforce (and fully 25 percentage points lower than for the higher wage workforce, on average). Maine and Iowa lead on low-wage access, while Arizona comes in last on low-wage participation: Only 19.8 percent of those making under $50,000 in Arizona are included in an employer-sponsored retirement plan, followed closely by Texas. Research shows that the lack of proper incentives and well-designed retirement savings programs contribute to this gap, not just the limited discretionary incomes of lower earners.

Figure 2.

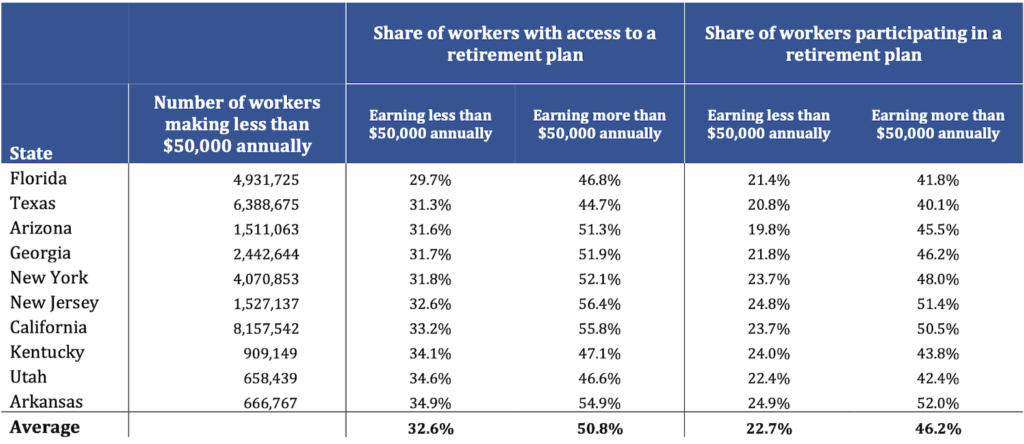

The country’s most populous states are among those with the least low-wage access

The 10 states with the lowest access rates for workers earning less than $50,000 (Table 1) include the country’s four most populous: California, Florida, New York, and Texas. Altogether, these 10 states account for 24 percent of the country’s total workforce, and an even more significant percent of the country’s low-wage workforce—43 percent. On average, less than one-third of the low-wage workforces in these states have access to a retirement plan and less than one-quarter of the low-wage workforce participates in one. Such low rates may partially be explained by variables that include large foreign-born populations, higher rates of informal or non-traditional employment relationships, and economic specialization in sectors such as leisure and hospitality, real estate, and construction, in which employer-provided plans are relatively rare.

Table 1.

In conclusion, retirement plan access and participation vary significantly by state, but low-wage workers are disproportionately likely to be left out everywhere. Since retirement savings constitute a large share of many Americans’ asset holdings, expanding access to and encouraging participation in retirement plans should be a public policy imperative so that more Americans have a stake in the U.S. economy’s wealth-creation power. As proposed in Hassett and Ghilarducci’s white paper, policymakers should seriously consider an expanded, federally-matched retirement plan for low-wage private sector workers modeled off of the federal Thrift Savings Plan to help achieve this goal in relatively short order and at relatively little cost.*

Data source and methods: We use the 2019 Current Population Survey’s Annual Social and Economic Supplement (CPS-ASEC processed by IPUMS), which asks respondents questions about their economic circumstances in 2018. We opted for the 2019 CPS-ASEC, as opposed to the 2020 release, because the 2020 survey was administered in March 2020 and likely suffered from lower response rates due to the COVID-19 pandemic. For our methodology, we follow Radpour, Papadopoulos, and Ghilarducci (2021). In particular, we restrict our sample to all wage and salaried workers (excluding self-employed and unpaid family workers) over the age of 25 who worked at some point last year and had non-missing income data. We coded individuals as having “access to a plan” if they responded that they either (1) had a retirement plan offered at work, but were not included (i.e. participating) in it, or (2) had a retirement plan offered at work, and were included in it. We coded individuals as “participating in a plan” only if they responded that they had a retirement plan offered at work, and were included in it.